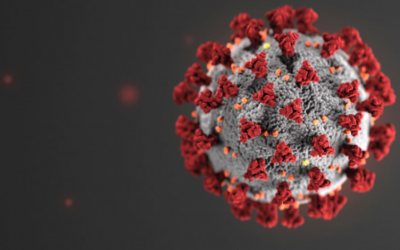

The Coronavirus is impacting business, perhaps we can help you with cash flow and tax incentives

Cost segregation and research tax credits can provide needed cash due to the coronavirus economic impact

How to Leverage Passive Activity to offset Ordinary Income

How does a Cost Segregation Study provide tax benefits? A cost segregation study is a strategic tax-planning tool that allows an owner to accelerate the depreciation of certain components of the building or land improvements over a shorter life. This is...

6 Tax Breaks You Can Still Claim for 2019

It’s not too late to grab these 6 tax breaks for 2019. Learn how you can save big and increase your cash flow.

Spending Bill Extends Expired 179D and 45L Energy Tax Incentives

In the final business week of 2019, government-funding legislation that the House passed a host of expired and expiring tax breaks known as “tax extenders” amendment.

Cost Segregation for Rental Properties

Learn how you can benefit from cost segregation and save big on your tax exemptions with your rental properties.

Cost Segregation for CPAs

Expand your services to your clients by offering cost segregation without doing any of the work. Our expert engineers will handle the entire process with audit protection and required documentation.

Understanding Cost Segregation for Multifamily Properties

Multifamily properties are very popular with investors and syndicators, especially for value-add properties where the rents are targeted for growth to coincide with unit renovations and upgrades to tenant amenities. Typically, a 5 to 7 year hold is planned to provide investors a solid rate of return, then a sale with proceeds distributed upon closing.

17 Tax Strategies To Discuss With Your Accountant

Review the possible money-saving tax credits, deductions, and strategies you may be missing out on. Print and share this checklist with your CPA or tax advisor to ensure you are maximizing your tax benefits.

Do cost segregation studies increase the chance of an audit?

Conducting a cost segregation study does not increase your chances of being audited, though you should always have sufficient protection through and engineered cost segregation study to be prepared in the event of an audit. While the IRS allows for and supports straight-line depreciation, they have stated that cost segregation by component is the proper way of handling depreciation.