How Does It Work?

Assets depreciate at different rates as defined by the IRS

Your commercial building has many different assets within it that can be separated out and classified differently. While some of the assets can only be depreciated over the standard amount of time (39 years for commercial property and 27.5 for residential), there are other assets that can be depreciated over a shorter time period. These assets will depreciate in either 5, 7, or 15 years depending on the asset and application.

Depreciating assets more quickly will decrease your current tax liability and free up your cash for other uses

Separating out your building’s component assets and depreciating them at a shorter life leverages the “time value of money”, versus standard straight-line depreciation.

Cost segregation helps you identify what assets can be depreciated faster.

What types of assets can be depreciated faster?

Many Flooring Systems

Millwork & Built-in Cabinetry

Specialty and Indirect Lighting

Specialty Electrical Systems

Specialty Plumbing

Parking Lot and Site Lighting

Landscaping

Stormwater Management Systems

Decorative and Security Fencing

and much more…

ELB Cost segregation uses its Engineers and knowledge of IRS Tax Code, Regulations, and Federal Tax Court Cases to accelerated depreciation to reduce current tax liability based on current tax law.

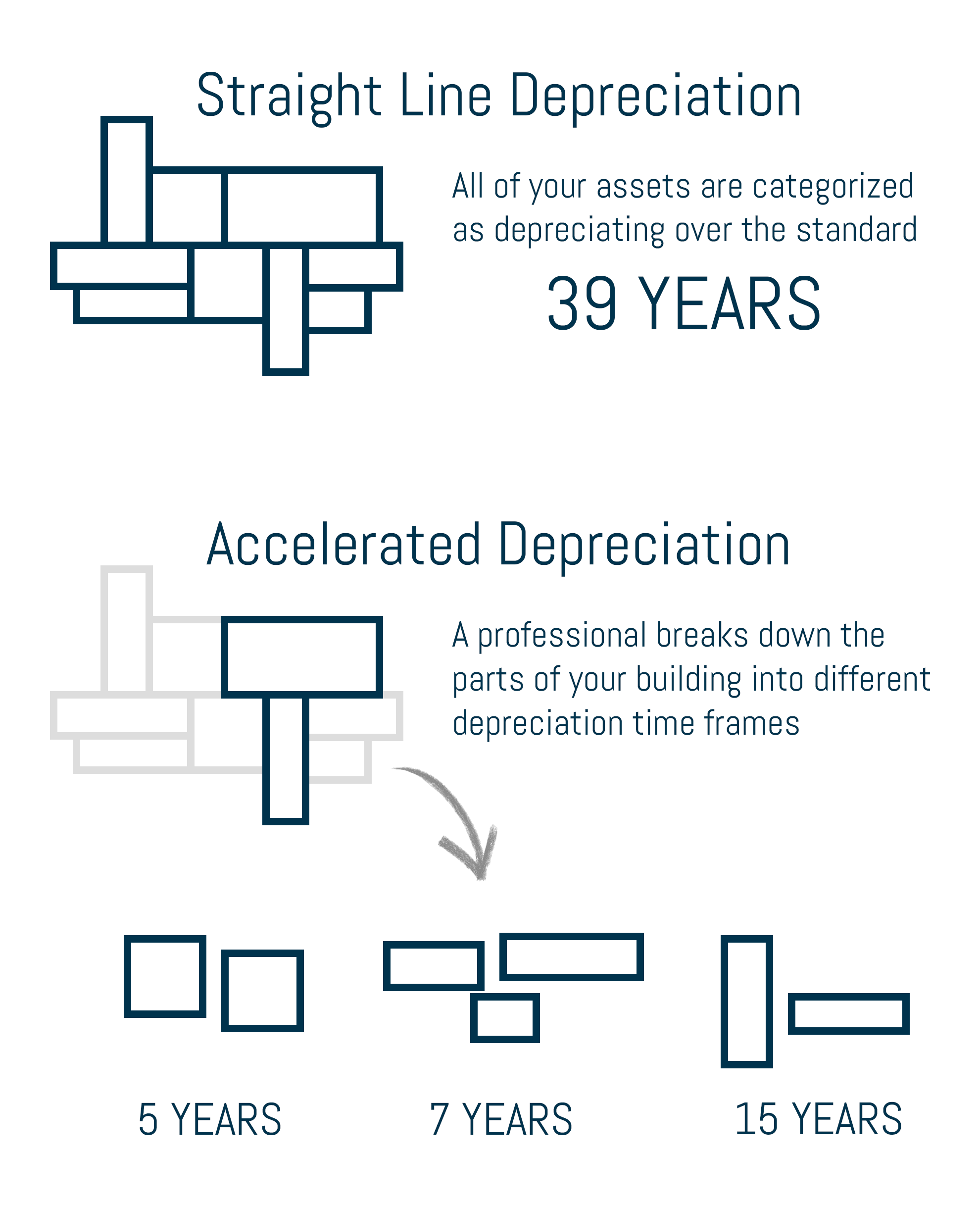

Straight Line vs. Accelerated Depreciation

Straight Line Depreciation

Straight line depreciation is the typical depreciation method used for commercial real estate properties and the assets within. This method depreciates all capitalized assets over 39 years, regardless of the actual usable life of the item. Therefore, a long-lasting piece of equipment is depreciated over the same time as a piece of equipment with a shorter lifespan as defined by the IRS.

Accelerated Depreciation

Accelerated depreciation allows you to identify and depreciate certain assets in a much shorter time frame. This gives you a decreased current tax liability so that you can take advantage of the additional income to put in your pocket or put back into your business for exponential returns in the future. Finding out which items are able to be classified as shorter-term depreciation takes an expert, however. You’ll need to speak with a professional to set up a cost segregation study.

What are the benefits of a cost segregation study?

Material reductions in your federal and state tax liabilities for the year of the study and the next decade, typically hundreds of thousands of dollars.

A detailed cost breakdown of the many components that comprise your building which will make repair, remodeling and replacement of the same less costly and more beneficial to you as you retire the replaced assets.

Generates immediate increase in cash flow through accelerated depreciation deductions by reducing Federal and State income tax.

Enables property owner to correct misclassified assets and the opportunity to claim, “catch up” in the current year.

Who Qualifies For Cost Segregation?

Commercial Real Estate Owners, Developers, & Investors

Leasehold Tenants Who Fund Their Own Tenant Improvements

Must Be A ‘For Profit’ Entity

Must Have a Tax Liability to Benefit

Cost Segregation Studies Are

Recommended by the IRS

“As a practical matter, cost segregation studies should be applied by the taxpayers.” – Internal Revenue Service

Source ->

17 Tax Strategies For Business Owners

TAX STRATEGY CHECKLIST

Discover 17 tax strategies to bring to your accountant and ensure you're making the most of your tax benefits. Enter your email address to download your free, printable copy.

SERVING ALL 50 STATES FOR OVER 20 YEARS

We've completed cost segregation studies in all 50 states across the USA.

SERVING ALL 50 STATES FOR OVER 20 YEARS

We've completed cost segregation studies in all 50 states across the USA.

Ready to get started?

Step One: Call or message us.

Call us at (888) 796-2112, submit the inquiry below for a call back, or request a free quote.

Click to call

Step Two: We perform a fully-engineered study of your property.

We'll do all the heavy lifting to find you the maximum tax deductions you qualify for.

Step Three: We deliver your 'CPA-ready' report.

Get a completed cost segregation study that decreases your tax liability and puts more money in your pocket.