by Bill Smith | Mar 30, 2020 | Uncategorized

You may have already heard that the long awaited the Energy Policy Act 2005 (EPAct) energy tax credits were extended in late December 2019. This retroactively extended both the 179D and 45L Energy Efficient Buildings from January 1, 2018 and to December 31, 2020....

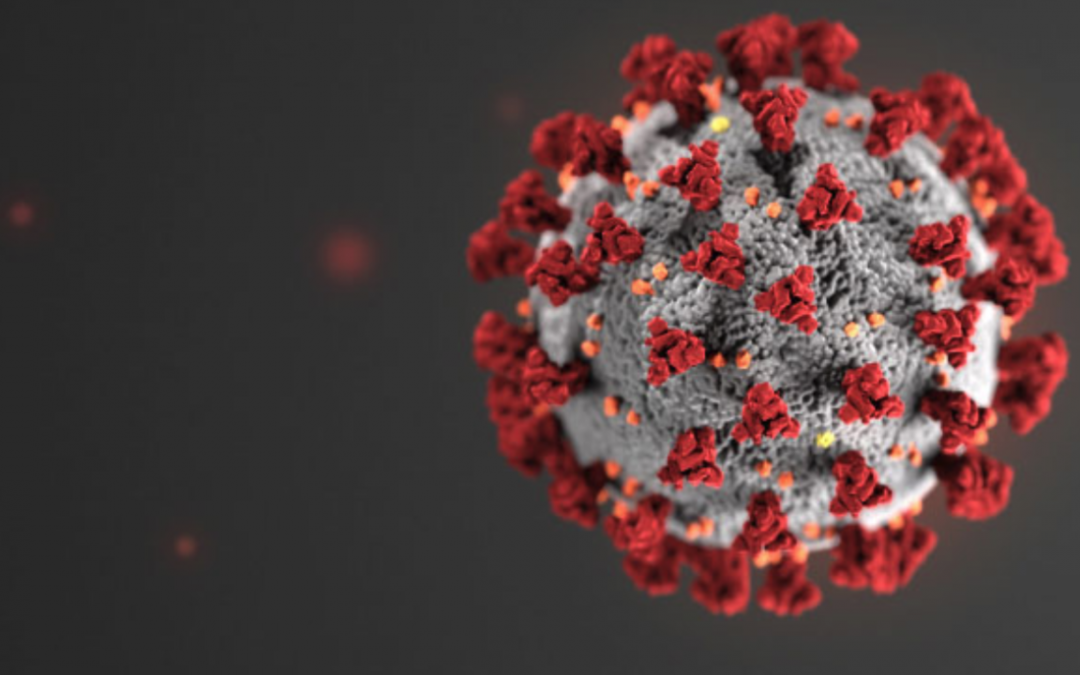

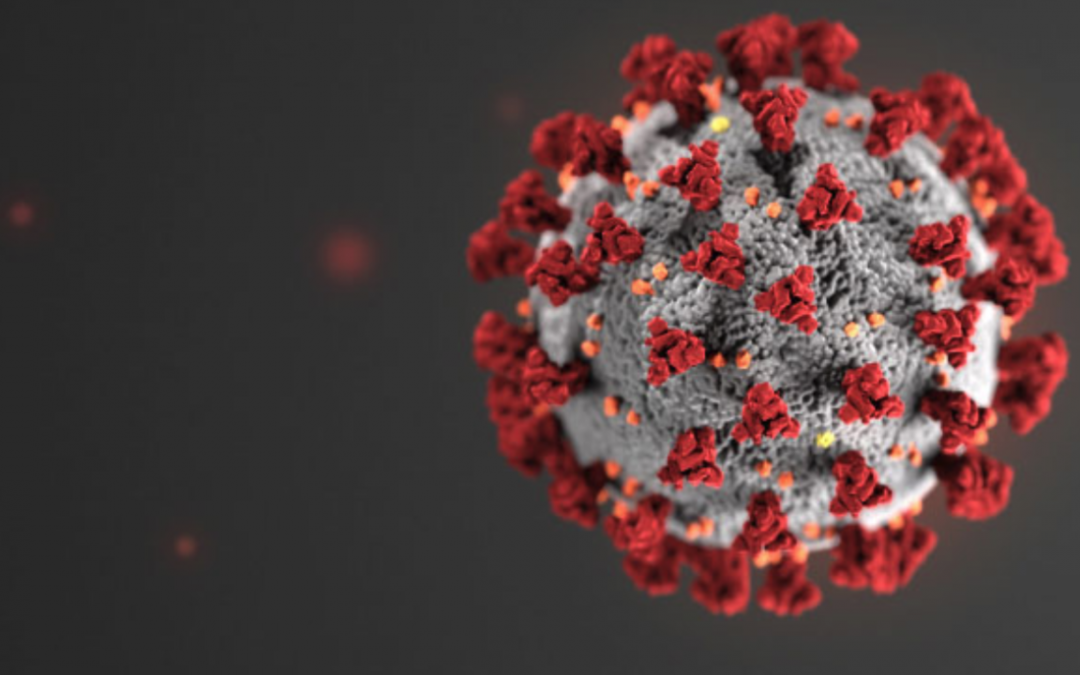

by Bill Smith | Mar 24, 2020 | Uncategorized

COVID-19 has completely changed our world in just a matter of weeks. As the Coronavirus has spread rapidly and its impact felt across our planet, communities and the economies; we are seeking ways to manage our life, businesses and finances. Well established tax...

by admin | Feb 18, 2020 | Uncategorized

How does a Cost Segregation Study provide tax benefits? A cost segregation study is a strategic tax-planning tool that allows an owner to accelerate the depreciation of certain components of the building or land improvements over a shorter life. This is accomplished...

by admin | Feb 10, 2020 | Uncategorized

You may be missing out on important tax cuts for the 2019 year. Read through the list below and contact our expert team to get started on your tax break. Tax Break One: Fully-Engineered Cost Segregation Study Do you own a commercial real estate property? There’s...

by admin | Dec 20, 2019 | Uncategorized

In the final business week of 2019, government-funding legislation that the House passed a host of expired and expiring tax breaks known as “tax extenders” amendment, including the Energy Policy Act of 2005 (EPAct 2005) 179D and 45L Energy Efficient Building...