What Industries Qualify?

Nearly any industry can qualify for research tax credits if they are able to show a material investment in research and development. Here are some examples of industries that commonly take advantage of R&D Tax Credits.

![]()

Manufacturing

![]()

Software

![]()

Engineering

![]()

Contractors

![]()

Construction

![]()

Insurance

![]()

Telecommunications

![]()

Tool & Die

![]()

Pharmaceutical

![]()

Biotechnology

![]()

Financial Institutions

![]()

Oil

Indicators of Qualified Research

The list below includes some good indicators of your research being able to qualify. If your projects require the use of the following resources, it’s a good sign for your qualification.

- R&D Departments

- Scientists

- Chemists

- Product Engineers

- Process Engineers

- Product Development

- Process Development

- Software Development

- Technology Development

- Patents

- And anyone involved in product or process innovation

How to Know If Your Research Qualifies for a Research Tax Credit

It can be confusing whether it’s worth it to pursue a research tax credit for your specific project. The 4-step method below can be used as a sort of checklist to see if your research will qualify. It’s not an all-inclusive list and every situation is different, but it will help you to determine whether it’s worth your time and effort.

GUIDELINE

#1

New or improved business component

The research must create a one-of-a-kind business component or improve upon an already existing one. If the product or improvement that you’re creating already exists in some capacity, it may not be accepted for qualification. Some examples of business components are:

- Product

- Process

- Technique

- Formula

- Invention

- Software item

GUIDELINE

#2

Technological in nature

In order to continue to innovate, the credit is only awarded to research that is technical in some nature or uses principles of the hard sciences.

GUIDELINE

#3

Uncertainty

In order for your research to qualify, it must be uncertain whether or not it will succeed. This includes a strong risk of failure and it must be documented to prove that this existed. This excludes your research if you’re being paid to complete it.

It doesn’t exclude you, however, if you’re developing a product that will be sold after the research is completed. Since your success relies completely on the completion of the research, that counts as a reasonable risk of failure.

This really is the underlying reason for the existence of the tax credit. The government wants to incentivize companies to take risks and potentially fail in order to continue innovating and stimulating the economy in the process.

GUIDELINE

#4

Process of experimentation

Your process must include documented experimentation and testing. The continued evaluation of the product or improvement is vital to show that you were making improvements and checking to see the success of the research throughout the entire process.

CURIOUS IF YOUR BUSINESS QUALIFIES?

Speak with our R&D Tax Credit experts to learn how much money you can save.

How to Know If Your Research Qualifies for a Research Tax Credit

It can be confusing whether it’s worth it to pursue a research tax credit for your specific project. The 4-step method below can be used as a sort of checklist to see if your research will qualify. It’s not an all-inclusive list and every situation is different, but it will help you to determine whether it’s worth your time and effort.

GUIDELINE

#1

New or improved business component

The research must create a one-of-a-kind business component or improve upon an already existing one. If the product or improvement that you’re creating already exists in some capacity, it may not be accepted for qualification. Some examples of business components are:

- Product

- Process

- Technique

- Formula

- Invention

- Software item

GUIDELINE

#2

Technological in nature

In order to continue to innovate, the credit is only awarded to research that is technical in some nature or uses principles of the hard sciences.

GUIDELINE

#3

Uncertainty

In order for your research to qualify, it must be uncertain whether or not it will succeed. This includes a strong risk of failure and it must be documented to prove that this existed. This excludes your research if you’re being paid to complete it.

It doesn’t exclude you, however, if you’re developing a product that will be sold after the research is completed. Since your success relies completely on the completion of the research, that counts as a reasonable risk of failure.

This really is the underlying reason for the existence of the tax credit. The government wants to incentivize companies to take risks and potentially fail in order to continue innovating and stimulating the economy in the process.

GUIDELINE

#4

Process of experimentation

Your process must include documented experimentation and testing. The continued evaluation of the product or improvement is vital to show that you were making improvements and checking to see the success of the research throughout the entire process.

Examples of Qualified Research Activities

Below is a partial list of research activities that can be accepted for research tax credits.

- New product development

- Product improvement

- Software development

- Internal use software development

- Design & engineering activities

- Process automation

- Tooling design

- New equipment development

- Equipment modifications

- Scale up activities for production

Qualified Research Expenses

Qualified research expenses (QREs) are absolutely vital for your acceptance for the research tax credit. You must be spending money and putting significant economic risk on the research in order to qualify. Below are the different categories that QREs can fall under and be accepted.

Wages

You’re able to get the credit back on the wages of employees that worked on the research, supported it in a substantial way, or directly supervised the research or researchers. It’s important to note that all employees there are having their wages counted towards the research credit must be filed under a W2 form.

80% or More Rule

If an employee spent 80% or more of their working time on the research and development, the IRS allows you to qualify 100% of their wages.

Supplies

Innovation takes a lot of investment; raw materials, equipment, and supplies are used to calculate your tax credit.

Contract Research

If your research requires the use of third-party testing labs or anything where you’re outsourcing an aspect of the research, it may qualify for the credit. Below are some important considerations when submitting contract research for an R&D tax credit.

- You must maintain ownerships rights of the research

- You must show a financial risk by paying for the research regardless of the outcome

- There is a 65% limit on contract research, so only 65% of your expenses will qualify

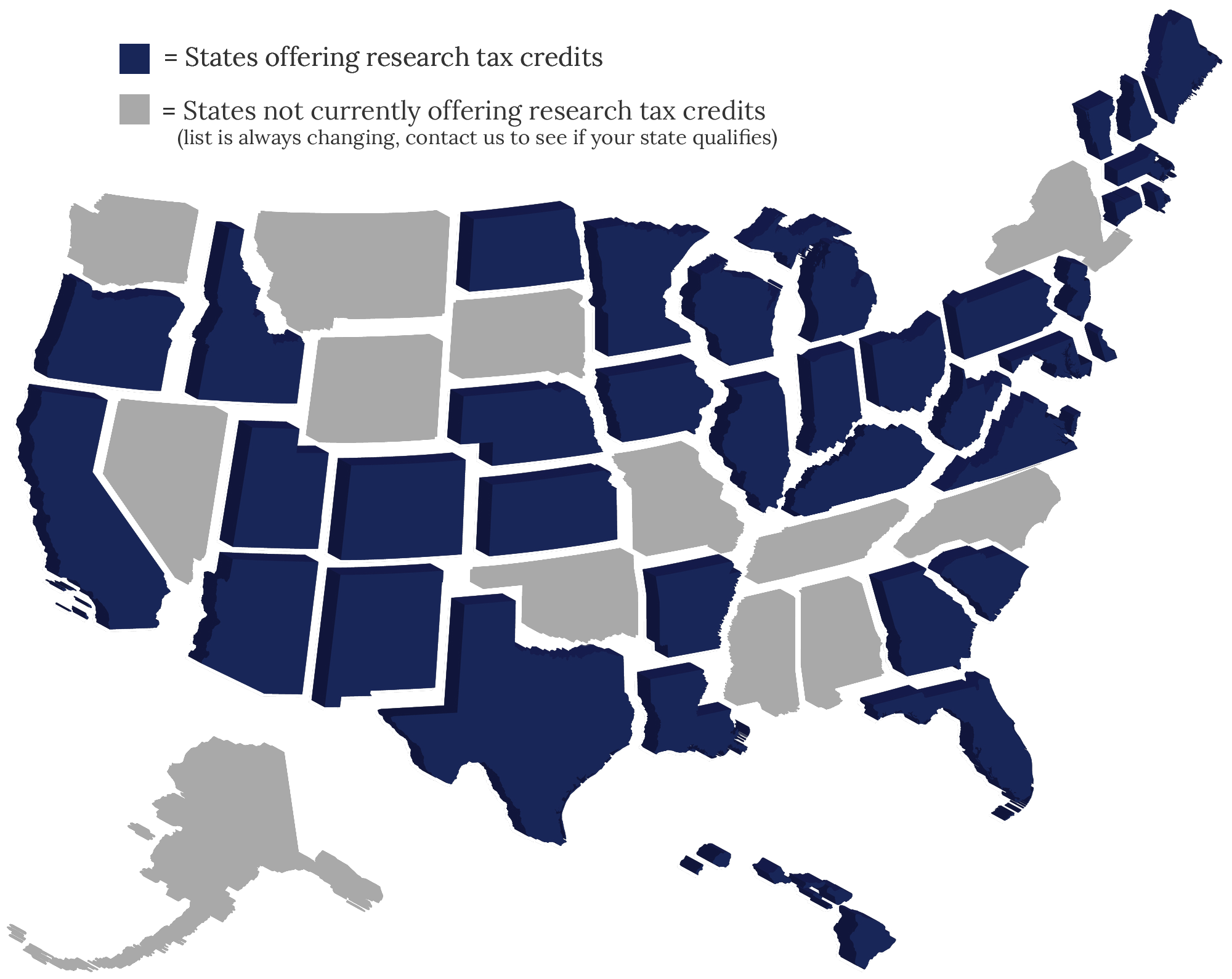

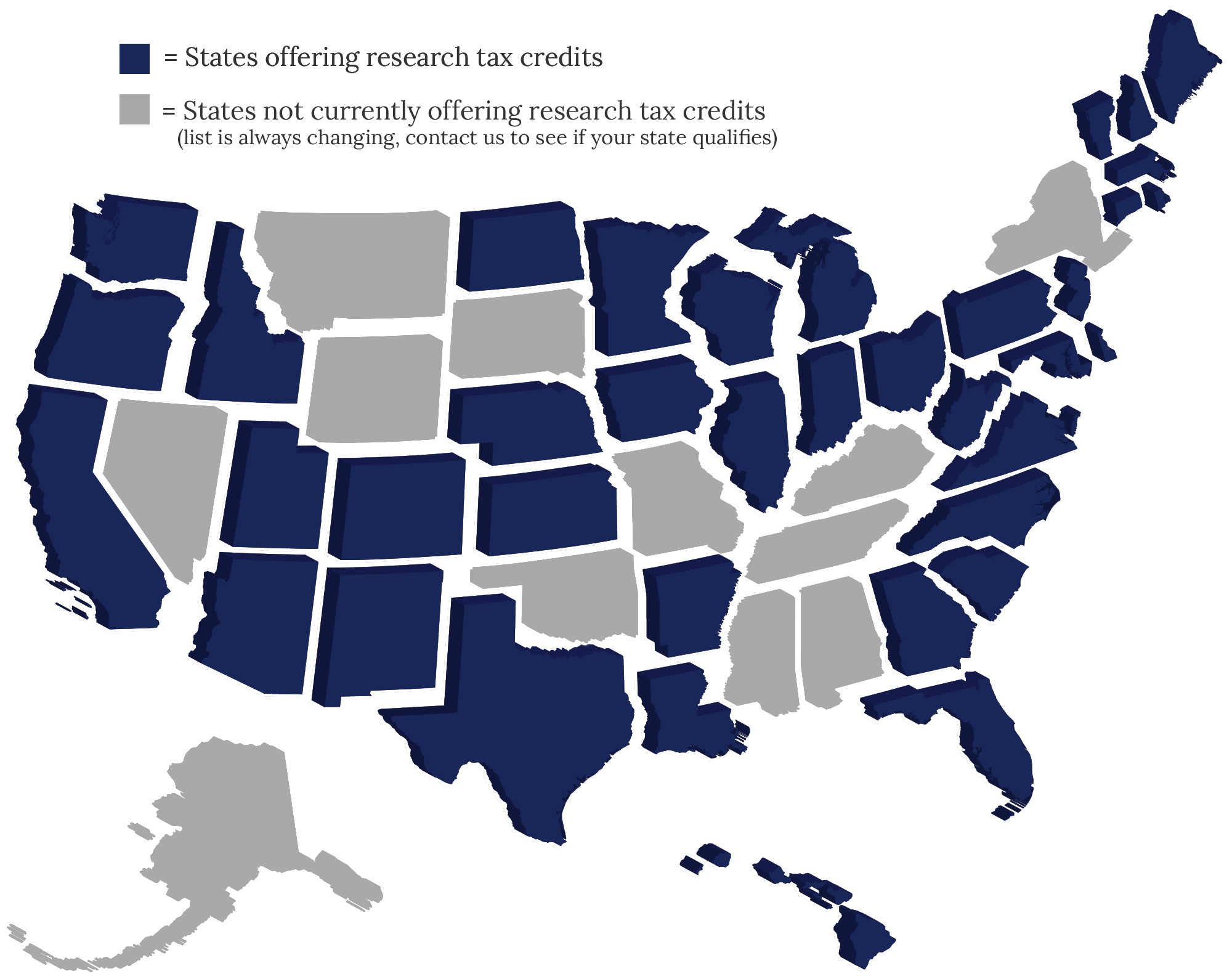

State Research Tax Credits

This list is always changing, so be sure to check that your state is still offering a Research Tax Credit. States will also commonly add credits, so you may be able to get one even if your state isn’t on this specific list.

The state that you may qualify for will be the state that your company operates in – not just any state that you offer services in.

- AZ

- AR

- CA

- CO

- CT

- DE

- FL

- GA

- HI

- ID

- IL

- IN

- IA

- KS

- LA

- ME

- MD

- MA

- MI

- MN

- NE

- NH

- NJ

- NM

- ND

- OH

- OR

- PA

- RI

- TX

- UT

- VT

- VA

- WA

- WV

- WI

- AZ

- AR

- CA

- CO

- CT

- DE

- FL

- GA

- HI

- ID

- IL

- IN

- IA

- KS

- LA

- ME

- MD

- MA

- MI

- MN

- NE

- NH

- NJ

- NM

- ND

- OH

- OR

- PA

- RI

- TX

- UT

- VT

- VA

- WA

- WV

- WI

How we qualify you for R&D Tax Credits

When it comes to proving to the IRS that you qualify for a research tax credit, it’s all about documentation. Our consultants fully document the credit according to the IRS Audit Techniques Guide. Our process identifies all wages, expenses, hours, and the effort put into your research and development to maximize the tax benefit.

Provide Financial documentation

Since the tax credit is based entirely on how much money went into your research, it’s vitally important to keep all receipts and statements regarding your financial contribution to the research and development tasks.

- Wages

- This typically requires the employee to keep track of the time they spent on each R&D-based project or task that they worked on. The employee must be working under a W2 for the wages to qualify.

- Supplies

- Contract research

Provide Project Documentation

When trying to qualify for a research tax credit, you’re expected to keep a well-documented list of all of the projects that went into the overall development or improvement.

Project narratives

A project narrative will also be required to describe the project and explain why it qualifies as part of the credit. If your research requires a large number of projects, it may not be absolutely necessary to have a narrative for every single one. In that case, you may be able to just submit them for the large, important projects.

Supporting project documentation

Supporting project documentation isn’t always required, but it may be asked for by an IRS agent, so it’s important to have it regardless.

Examples of supporting project documentation:

- Meeting minutes

- Project status updates

- Test reports

- Test analysis

- Technical emails

- Logbooks

- Revision history

Additional documentation

When it comes to documentation, it’s typically better to have more. This is especially true when your narratives and other documentation is lacking. This additional documentation may also be low-effort to create, so it’s worth throwing in the pile. Some examples are:

- Job descriptions

- department overviews

- R&D process overview

17 Tax Strategies For Business Owners

TAX STRATEGY CHECKLIST

Discover 17 tax strategies to bring to your accountant and ensure you're making the most of your tax benefits. Enter your email address to download your free, printable copy.

Ready to get started?

Step One: Call or message us.

Call us at (352) 796-2112 or submit the form below to get started.

Step Two: We perform a fully-engineered study of your property.

We’ll do all the heavy lifting to find you the maximum tax incentives you qualify for.

Step Three: We deliver your ‘CPA-ready’ report.

Get R&D Tax Credits that decrease your tax liability and puts more money in your pocket.