What does Section 1245 do?

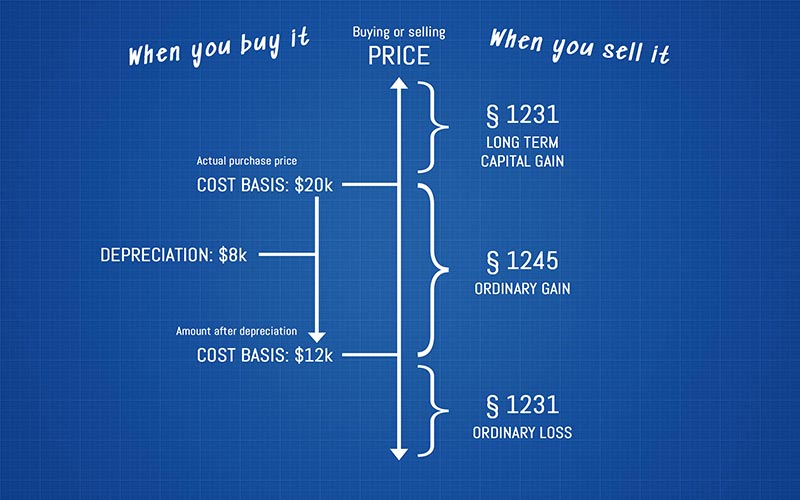

When you sell a non-real estate asset for more than its current depreciated value, Section 1245 defines how much of the sale price is taxed as ‘Ordinary Gains’ versus ‘Long-term Capital Gains’.

What does Section 1245 Cover?

An important thing to note about Section 1245 is that it does not apply to real estate. Instead, it can only be applied to tangible properties that are not real estate. Some examples of properties that work under Section 1245 are office furniture, equipment, vehicles, machinery, and other vital business items.

Obviously, this is going to differ greatly depending on the use of your building and what you need to run the business that operates inside of it. When you purchase the property that goes in your building, the government allows you to depreciate it over time. However, Section 1245 adds a bit of a stipulation. If you resell the property at a higher price than your depreciated price, it gets filed as Ordinary Gain. This means that it is taxed without the corporate tax cuts of Long Term Capital Gain.

If you sell higher than your original purchase price (not accounting for depreciation), any additional gain is then classified as Long Term Capital Gain and will have a reduced tax rate.

How does Section 1245 work?

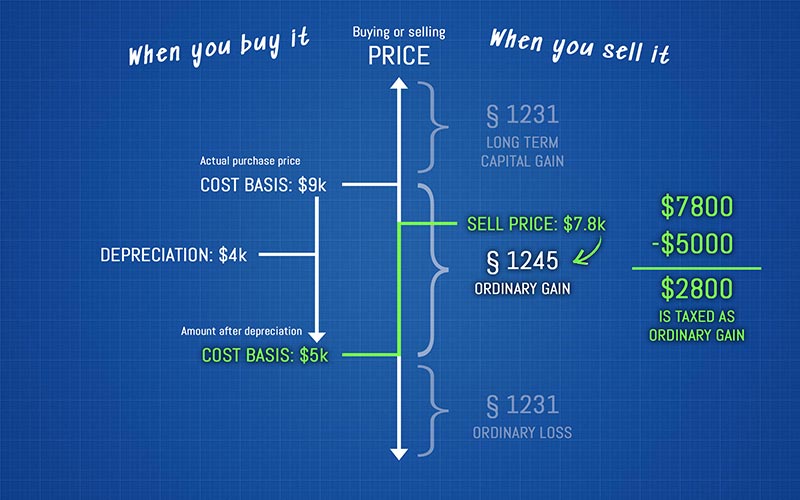

Let’s take a look at an example.

Here’s the scenario for the graph below. Janet is a building owner and purchased $9000 worth of office equipment to rent out her space to other businesses. She established a $4000 depreciation. However, she then turns around and sells the equipment for $7800. Therefore, the difference between her final sale price ($7.8k) and her original depreciated price ($4000) is taxed as Ordinary Gain.

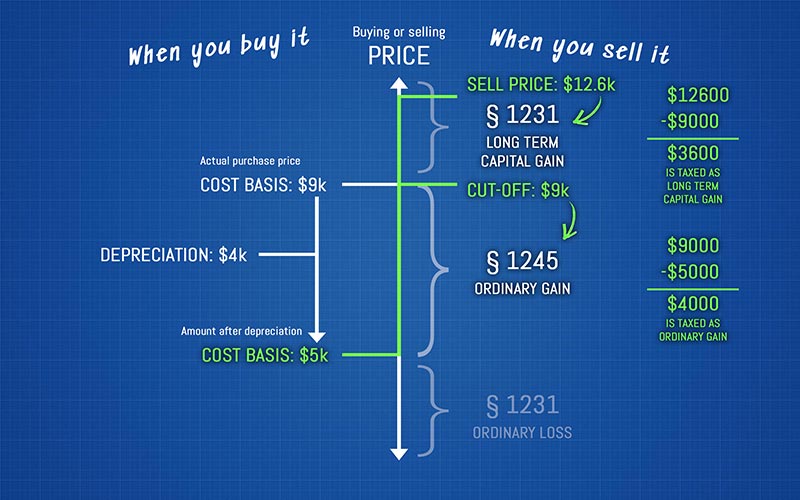

Let’s look at a more complicated situation.

In the graph below, Greg purchased $9000 worth of equipment for his steel mill and got a $5000 depreciation. However, when he turned out to sell the equipment, he found a buyer for $12600. This means that from his adjusted depreciated basis ($5k) to his original purchase price without depreciation ($9k), the amount is taxed as Ordinary Gain. The additional profits beyond his purchase price are taxed as long term capital gain.

How Can You Benefit from Section 1245?

Our cost segregation experts can help you understand how Section 1245 applies to your specific circumstances. Contact us to learn how you can save big on your taxes with professional advice from experienced tax experts.

Ready to get started?

Step One: Call or message us.

Call us at (888) 796-2112, submit the inquiry below for a call back, or request a free quote.

Click to call

Step Two: We perform a fully-engineered study of your property.

We'll do all the heavy lifting to find you the maximum tax deductions you qualify for.

Step Three: We deliver your 'CPA-ready' report.

Get a completed cost segregation study that decreases your tax liability and puts more money in your pocket.